Any behavioural scientist will tell you that if your body language mirrors a significant other for a period of time, then a subconscious bonding takes place that creates empathy and rapport.

Our latest research paper which tests the findings of the Financial Advice Market Review (FAMR) against what clients want and need, shows that despite great work by the industry on individual professional development (namely diploma and chartered advisers and certified planners) we still have a way to go for the firms themselves to showcase professional service development.

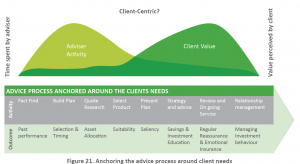

Our diagram which builds on research conducted over 10 years ago shows that adviser firms are still fairly transactional in their approach to meeting their client needs and are yet to gain a full understanding of what they prize and value and how this can be incoporated into the client service proposition.

Our diagram which builds on research conducted over 10 years ago shows that adviser firms are still fairly transactional in their approach to meeting their client needs and are yet to gain a full understanding of what they prize and value and how this can be incoporated into the client service proposition.

This research finds there are 5 key themes to engaging consumers in their financial planning process.

Education

Whether consciously or not, consumers are showing signs that they need tailored information, guidance and advice to help them make better and more informed decisions with their finances. They are becoming digitally savvy and thus are prime for the new FinTech tools beginning to populate service propositions.

Professionalism

There is no doubt consumers will defer to authority when it comes to investment choices. Although they are more informed, they prize a firm that espouses professional prowess and employs professionally minded and engaged staff.

Easy access and flexibility

For firms to answer the ‘what’s in it for me’ question consumers tend to ask, they need to make products and services easy to access and build in flexibility to cater for consumer’s life events.

Value for money

Without perceived value and salient outcomes it is quite clear consumers will not be interested in paying for advice or buying into direct offerings. So by offering a 5 step process firms can offer value that these consumers say they will pay for: Discretion – They want information, guidance and advice so they can consider the right services and products available. Choice – Tailored services that match their needs is highly desired. Fungibility – The ability to transfer funds between providers is very attractive. Behavioural coaching – Ensuring and recognising the value in staying in their seat during volatile markets is an attractive proposition. Safety – Ensuring the risks are managed via managing capacity for loss and their composure under pressure is managed is also viewed as a valuable service.

Influence

Consumers find if their interests are incorporated into product and service design and they are represented fairly and accurately then this would heighten their engagement with the industry.

The problem is the industry has been a tad like a dad at his daughters wedding when he’s had a few and let off steam on the dance floor when it comes to expressing itself. What it requires is a nuanced approach that incorporates consumer needs and embraces the FinTech and digital tools that can offer bright, shiny and engaging tools to encourage a culture for savings and investing.

The signs are there but we think there are serious dancing lessons required before professional service firms evolve into truly client centric propositions.

You can learn more about getting the right moves by downloading our paper at:

http://engageinsight.co.uk/the-evolution-of-retail-financial-services-from-the-rdr-to-the-famr/